What Is The Best Credit Card Utilization

What Is The Best Credit Card Utilization. Though most experts recommend keeping your credit utilization ratio under 30 lower is better. It measures the amount of available credit you are using. There is also your credit mix 10 percent your credit history. For example if you have a 10000 credit limit and a 5000 balance your credit utilization is 50.

As a rule you never want your balances to be more than 25 30 percent of total your credit limits.

What is the best credit card utilization. The basic formula for calculating credit utilization is to divide your credit card balance by your credit card limit then multiply by 100. If your credit card balance is 250 and your account limit is 1000 your credit card utilization rate is 25. It measures the amount of available credit you are using.

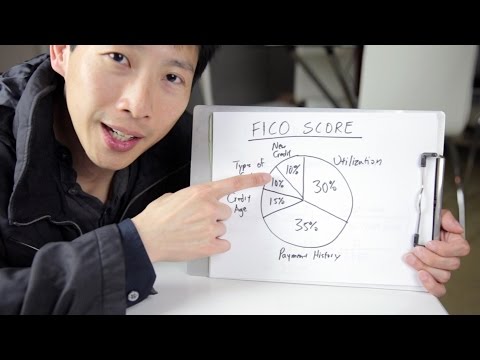

Credit Balance Credit Limit x 100 Credit Utilization Ratio You can. Typically a credit utilization ratio of 30 is considered to be perfect. Utilization is only one part of the credit scoring matrix-your payment history is most important to your FICO score at 35 percent.

Lower credit utilization rates suggest to creditors that you can use credit responsibly without relying too heavily on it so a low credit utilization rate may be correlated with higher credit scores. Your credit utilization which refers to the ratio of your amounts owed to your total available credit plays a big role in determining your creditworthiness. Depending on the scoring model used some experts recommend aiming to keep your credit utilization rate at 10 or below as a healthy goal to get the best credit score.

Also known as your debt-to-credit ratio it is the ratio of your overall outstanding balance to your overall credit card limit. Credit utilization ratios make up 30 of your credit score making it the second biggest factor in determining your credit score the first being your payment history. However the individual utilization ratios of your respective credit cards are 90 450 balance 500 credit limit and 16 550 balance 3500 credit limit.

Though most experts recommend keeping your credit utilization ratio under 30 lower is better. You calculate your credit utilization ratio on a single card by dividing your current balance by your credit limit and multiplying it by 100. 250 Balance 1000 Limit 025 x 100 25 Utilization Ratio.

Your total credit utilization rate is 50 percent. To put it into numbers if youve got a 5000 limit across your. However a credit utilization of 50 is not ideal.

Credit card utilization is a rate that indicates how much of your available credit youre using. If youre adding 500 per month of new charges on your card and your limit is 1000 youll have a utilization rate of 50. Since credit scores consider individual utilization ratios not just overall utilization having any single revolving account at 90 utilization is going to weigh negatively on the credit utilization portion of your score.

Most experts recommend keeping your overall credit card utilization below 30. If each card has a credit limit of 5000 and you owe 3000 on one and 2000 on the other your per-card utilization rates would be 60 and 40 respectively. Lower utilization is virtually always better for your credit scores though a ratio of 1 is often considered the ideal credit utilization rate.

Credit utilization makes up roughly 30 of your credit score which makes it one of the most important factors in your credit report. So if you have a 10000 limit and a 2000 balance. The truth is maintaining a 0 credit utilization ratio on your rewards card is the best way to get the most out of your rewards card.

To figure out your credit utilization ratio divide your total balance by your total credit limit and multiply by 100. In general the lower your credit utilization the better but anything below 30 is considered good and 0 may not necessarily be the best ratio to have. For example if your balance is 300 and your credit limit is 1000 then your credit utilization for that credit card is 30.

In general the people with the highest credit scores have a utilization rate of under 10 percent. To calculate it divide your total credit card balances how much you owe by your total credit card limit how much you could spend. The higher either ratio is the worse the impact will be on your credit score.

You maximize credit card rewards by never paying interest and maintaining a zero balance when your credit activity is reported to the bureaus Adam Selita CEO of The Debt Relief Company explains. Credit utilization is the ratio of your outstanding credit card balances to your credit card limits. In other words youre using 25 of the maximum credit limit on your account.

In fact according to FICO credit card holders with top scores use an average of 7 of their. So if you have a 2000 credit limit and you have currently have 800 worth of purchases on your credit card your CCU rate is 40 percent. Paying down credit card debt and keeping balances low can be very beneficial to your scores.

Paying 20 interest on a credit card that offers 2 cash back is moot.

This page has many information about what is the best credit card utilization. CRedit's main goal is to improve your credit, keep it healthy, and support you in decisions that you make that may affect your credit livelihood. We are here to support you if you need an advice on closing/opening a credit card, improving your credit scores, removing inaccurate information from your report, qualifying for a new card/mortgage/loan, investigating unknown information on your .... Credit utilization is 30% of your FICO score, so it's a big factor to keep in mind. Example: You have a credit card with a $5,000 limit. Let's say your balance is $2,000.. Most experts recommend keeping your overall credit card utilization below 30%. Lower credit utilization rates suggest to creditors that you can use credit responsibly without relying too heavily on it, so a low credit utilization rate may be correlated with higher credit scores.. Your total credit utilization rate is 50 percent. If each card has a credit limit of $5,000 and you owe $3,000 on one and $2,000 on the other, your per-card utilization rates would be 60% and 40%, respectively.. Utilization is only one part of the credit scoring matrix-your payment history is most important to your FICO score at 35 percent. There is also your credit mix (10 percent), your credit history....

Videos of what is the best credit card utilization:

Duration: 11:18. Views: 4.2K views

Duration: 29:47. Views: 433 views

Duration: 4:12. Views: 91 views

Duration: 3:29. Views: 965 views

Duration: 5:51. Views: 230K views

Duration: 1:35. Views: 1.2K views

Duration: 9:50. Views: 5.1K views

Duration: 4:13. Views: 84K views

Duration: 5:32. Views: 55K views

Duration: 7:09. Views: 125 views

Duration: 10:26. Views: 36K views

Duration: 17:01. Views: 5.6K views

Duration: 1:37. Views: 359 views

Duration: 12:20. Views: 6.3K views

Duration: 18:57. Views: 89K views

Duration: 1:30. Views: 1.3K views

Duration: 24:16. Views: 17K views

Duration: 18:24. Views: 2K views

Credit utilization is the ratio of credit card balances to credit limits. Use our credit utilization calculator to check yours and see how it affects your credit score.. The truth is, maintaining a 0% credit utilization ratio on your rewards card is the best way to get the most out of your rewards card. "You maximize credit card rewards by never paying interest and maintaining a zero balance when your credit activity is reported to the bureaus," Adam Selita, CEO of The Debt Relief Company, explains. "Paying 20% interest on a credit card that offers 2% cash back is moot.. To figure out your credit utilization ratio, divide your total balance by your total credit limit and multiply by 100. Credit Balance ÷ Credit Limit x 100% = Credit Utilization Ratio You can.... For instance, if your credit limit is $5,000 and you're spending $3,000 a month, your utilization is 60%. However, if you raise your credit limit to $10,000 and still leave a balance of $3,000, then your utilization drops down to 30%. You can call your credit card company and ask them to raise your limit.. You calculate your credit utilization ratio on a single card by dividing your current balance by your credit limit and multiplying it by 100. So if you have a $10,000 limit and a $2,000 balance,.... In general, the people with the highest credit scores have a utilization rate of under 10 percent. Paying down credit card debt and keeping balances low can be very beneficial to your scores. As a rule, you never want your balances to be more than 25 — 30 percent of total your credit limits.. Credit card utilization is a rate that indicates how much of your available credit you're using. To calculate it, divide your total credit card balances (how much you owe) by your total credit card limit (how much you could spend). So, if you have a $2,000 credit limit, and you have currently have $800 worth of purchases on your credit card, your CCU rate is 40 percent.. Also known as your debt-to-credit ratio, it is the ratio of your overall outstanding balance to your overall credit card limit. To put it into numbers, if you've got a $5,000 limit across your.... Credit utilization makes up roughly 30% of your credit score, which makes it one of the most important factors in your credit report. In general, the lower your credit utilization the better, but anything below 30% is considered "good," and 0% may not necessarily be the best ratio to have.. The higher either ratio is, the worse the impact will be on your credit score. Credit utilization ratios make up 30% of your credit score making it the second biggest factor in determining your credit score, the first being your payment history. Typically, a credit utilization ratio of 30% is considered to be perfect.. Depending on the scoring model used, some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score.. Some experts recommend keeping your credit utilization rate below 30%, but two credit gurus CNBC Select spoke to say it should be much lower than that if you want a good credit score.. Credit utilization is the ratio of your outstanding credit card balances to your credit card limits. It measures the amount of available credit you are using. For example, if your balance is $300 and your credit limit is $1,000, then your credit utilization for that credit card is 30%. If you're adding $500 per month of new charges on your card and your limit is $1,000, you'll have a utilization rate of 50%..

Posting Komentar untuk "What Is The Best Credit Card Utilization"